Since its inception in 1990, the EB-5 Immigrant Investor Program has funded the creation of hundreds of thousands of new jobs and contributed billions in foreign capital to the U.S. economy.

Foreign investors who provide EB-5 investment capital receive green cards if their investment satisfies the EB-5 program’s various requirements, such as making an investment that meets the minimum required investment amount, keeping the investment at-risk for the duration of the EB-5 investment, proving that the EB-5 investment fund was legally sourced, and creating 10 full-time jobs for U.S. workers. These requirements can be difficult to satisfy, with the most difficult often being the minimum required investment amount. Standing at $1.8 million, the minimum required investment amount can nullify many prospective EB5 investment journeys. However, projects qualify for a reduced investment amount of $900,000 if they are in a targeted employment area (TEA). TEA projects offer the same U.S. permanent residency benefits as non-TEA projects at half the cost.

How is TEA Eligibility Calculated

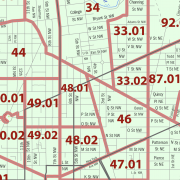

There are two different types of TEAs, rural TEAs and high-unemployment TEAs, with high-unemployment TEAs making up the majority. Rural TEAs are comparatively easy to calculate. To do so, an investor must use the latest 10-year U.S. census data to show that the area has fewer than 20,000 inhabitants and is not located in a metropolitan statistical area (MSA) or on the outskirts of an area with more than 20,000 inhabitants.

To qualify as a TEA on the basis of high-unemployment, an area must have an unemployment rate 50% above the national average, according to current and reliable census-tract-level unemployment data. EB-5 investors can pull figures from either Bureau of Labor Statistics (BLS) annual county-level data or American Community Survey (ACS) five-year census-tract data. EB-5 investors typically target a census-tract-level TEA, which gives them two calculation options: they can use the imprecise five-year estimates from ACS or combine annual county-level data from BLS with the five-year ACS data to create a more precise estimate. The second option is called the census-share method.

How Can Poor Timing Disqualify a Project’s TEA Eligibility?

Investors must use the most recent available unemployment data when demonstrating TEA eligibility in their I-526 petition to United States Citizenship and Immigration Services (USCIS). If an investor submits their I-526 but the unemployment rate then decreases such that the area no longer has a rate 50% above the national average, they are still eligible for the lower investment amount if the area qualified as a TEA when the I-526 was submitted.

However, if there is fluctuating unemployment data during the project planning stage, investors may be in danger of not qualifying for the minimum investment amount and being forced to make a $1.8 million EB5 investment.

What Are Rolling Monthly Calculations of Census Tract Unemployment Data?

While ACS only releases figures yearly in a five-year data chunk, BLS releases unemployment data monthly, although there is a two-to-three-month lag. Investors typically use BLS’s annual releases, which are published in April of the following year, to obtain a more accurate estimate of unemployment levels. However, if an investor uses BLS’s monthly data releases from the most recent 12 months, this calculation would result in the best possible estimate of current unemployment data.

This calculation method is called the “rolling average,” as it covers a 12-month period with periods in two different calendar years. During the COVID-19 pandemic, which has affected the EB-5 investment program in several ways, this calculation could be especially valuable, as it would show the devastating economic effects of the pandemic faster than the annual data from BLS, expected to be published in April 2021. It should also be noted that the rolling average calculation method is an atypical calculation method that could confuse a USCIS adjudicator.

If an EB-5 investor chooses to use this method, it is vital to compare the Census Tract Unemployment Data to the same period’s national unemployment data. EB-5 investors must not present data from different time periods, even if these periods overlap, as it constitutes an invalid TEA calculation.

Investors are recommended to file their I-526 petition using the most recent BLS monthly data. The rolling average calculation should also be revised to include next month’s data, if it is released during the I-526 preparation period.

How Can You Calculate TEA-designation Using a Period of Less Than a Year?

An EB-5 investor may be interested in determining whether they can calculate TEA eligibility using data from different periods ranging from several months to just one month.

USCIS has not given any specific instructions regarding this type of calculation method, although prospective investors should know that this remains unexplored territory. The immigration body did indirectly consider a one-month TEA eligibility calculation in a data release in March 2020, with the example calculation only spanning a one-month period and USCIS choosing to ignore the calculation period in its answer with regards to the main point of inquiry. However, this should not be considered acceptance of this calculation method.

Since unemployment data can fluctuate greatly month over month, a USCIS adjudicator may not accept a rolling average calculation with a period of less than one year, as it may be felt that this calculation inaccurately represents the region’s unemployment situation.

During the COVID-19 crisis, this danger is magnified because a rolling average calculation over a short period could accentuate unemployment figures that may not continue into the post-COVID recovery. As most I-526 petitions will not be adjudicated until approximately two years following submission, it is unlikely that this type of calculation would be effective. While the government may want to exercise more leniency due to the destructive effects the pandemic has had on the U.S. economy, prospective EB-5 investors hoping to immigrate to the United States are strongly encouraged to avoid making such a gamble on their EB-5 investment.