In early November 2020, Invest in the USA (IIUSA) held a two-week virtual conference that was meant to cover a wide variety of EB-5 topics. Sarah Kendall, chief of the Immigrant Investor Program Office (IPO), was one of the guest speakers at the conference, and attendees had the opportunity to submit EB-5 questions they would like answered.

Despite this appearing to be a great opportunity for all of those involved with EB-5 investments to have their questions answered, the event ended up being a major disappointment. Many of the questions were sidestepped, if not completely avoided. Now that the conference is over, the material from the first day of the conference can be accessed as a PDF, a YouTube video, or as a presentation from IIUSA.

The Positive Updates

Even though the information presented by the IPO was disappointing for the most part, there were still a couple of positive updates. The IPO did address the problem of I-829 biometrics appointment scheduling and the delayed transmission of approved I-526 petitions to the National Visa Center. The agency stated that I-829 biometric appointments for EB-5 investors and their family members were being scheduled on different days due to a bug in their system, but they are dedicated to fixing this issue. As for the I-526 transmission, the delay was caused by the understaffing of the IPO.

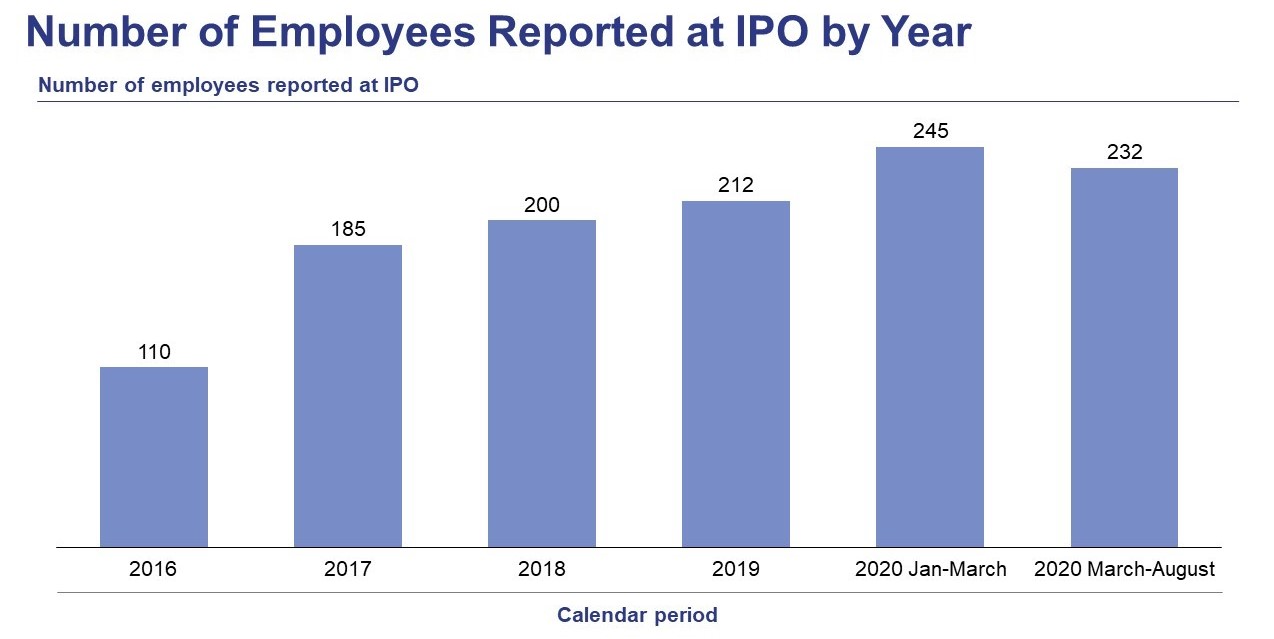

The IPO was transparent in revealing that they have 232 people on staff dedicated to EB-5 petitions. This is 13 fewer people than they had on staff in March 2020. Being that the majority of the IPO’s staff have kept their jobs, EB-5 investors should be relieved knowing that the understaffing is minimal. This is much better news than the potential furlough United States Citizenship and Immigration Services (USCIS) faced in August 2020, which would have resulted in the loss of 70% of the agency’s staff.

Many Questions Sidestepped or Avoided

Much of the rest of the conference was little or no use to those involved with an EB5 investment. The IPO carefully avoided many relevant questions and issues that would have been significant for prospective EB-5 investors and others in the EB-5 industry.

IIUSA had created a list of questions for the IPO conference, but many of them were ignored. The IPO did not acknowledge any questions on the policy manual, changes to policy in regard to EB-5 investment capital sources, country-based I-526 processing data, and the redeployment policy. When the IPO did choose to respond to a question, it was typically a question of no use to those in the EB-5 industry. The IPO simply offered vague information that was already well known without addressing any of the specific questions or concerns presented by EB-5 investors and stakeholders.

What made this even worse was that the conference did not allow any interaction. Sarah Kendall did make a live appearance, but she did not allow for any questions. Instead, she repeated the same vague information that is already widely available, leaving EB-5 investors and stakeholders with no new information or reassurance about the future of the program.

The IPO Revealed Faster Processing Times for Investments in Previously Reviewed Projects

One question many EB-5 investors had was how I-526 petitions were adjudicated from countries with available visas. The new visa availability approach states that I-526 petitions from countries with available visas will be prioritized over those submitted by applicants from backlogged countries. But many were still left wondering if the petitions from countries with available visas would be processed on a first-in, first-out basis.

During the conference, the IPO indirectly revealed that after visa availability, the most important factor is if USCIS has already reviewed the EB-5 project in the past, from a previous investor’s petition or an exemplar I-924 petition. Many anecdotal accounts have already suggested this may be the case. This further complicates the EB-5 process and creates more inequality within the adjudication process.

Unreasonably Low Processing Volume

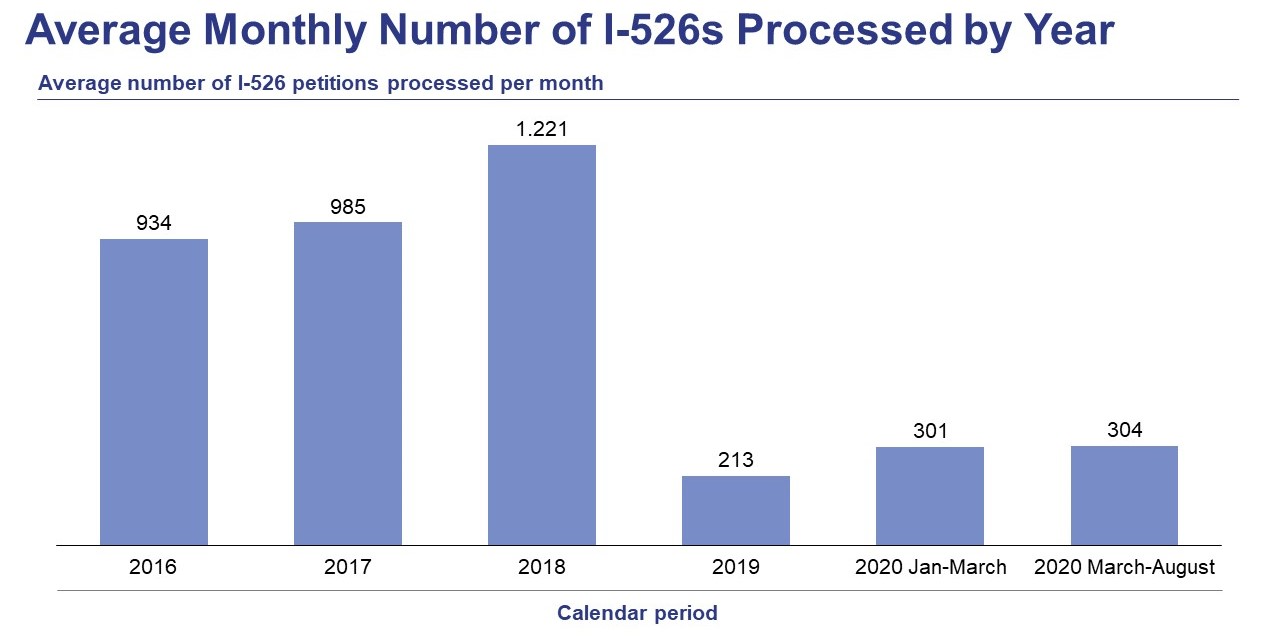

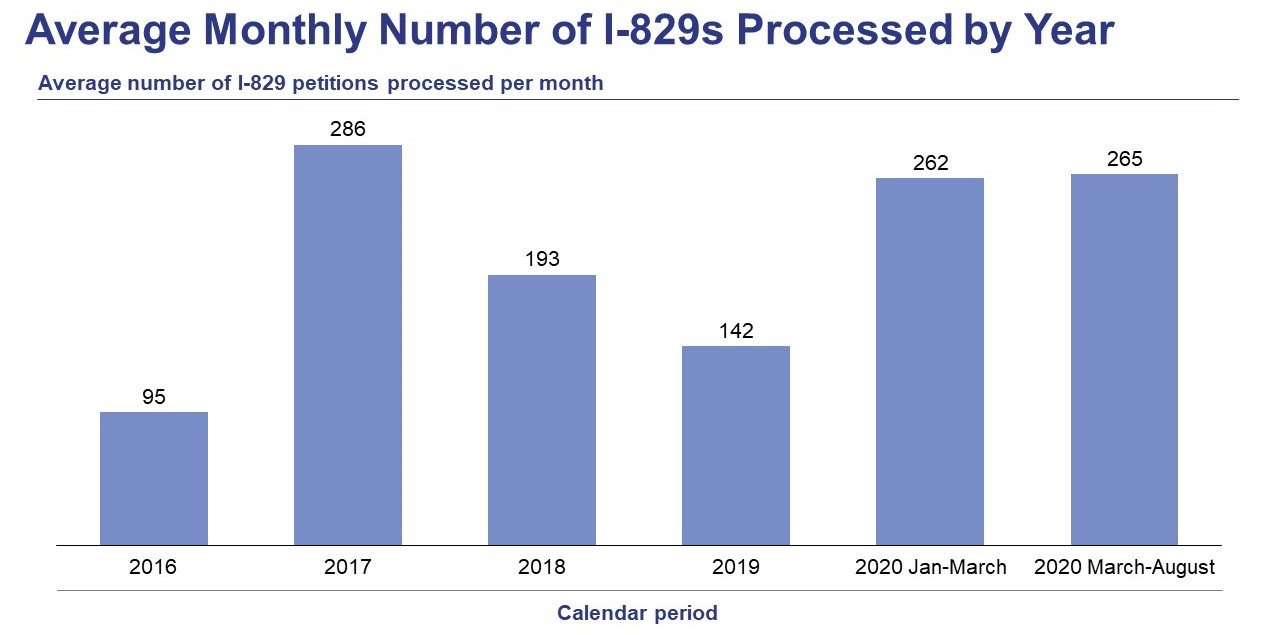

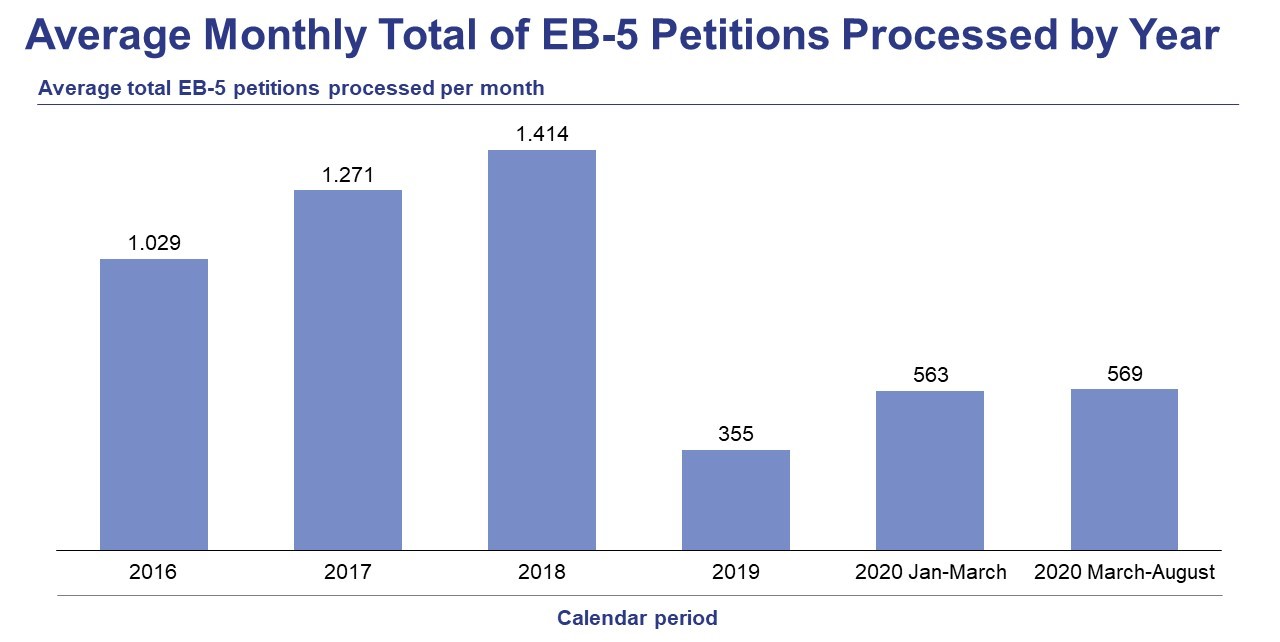

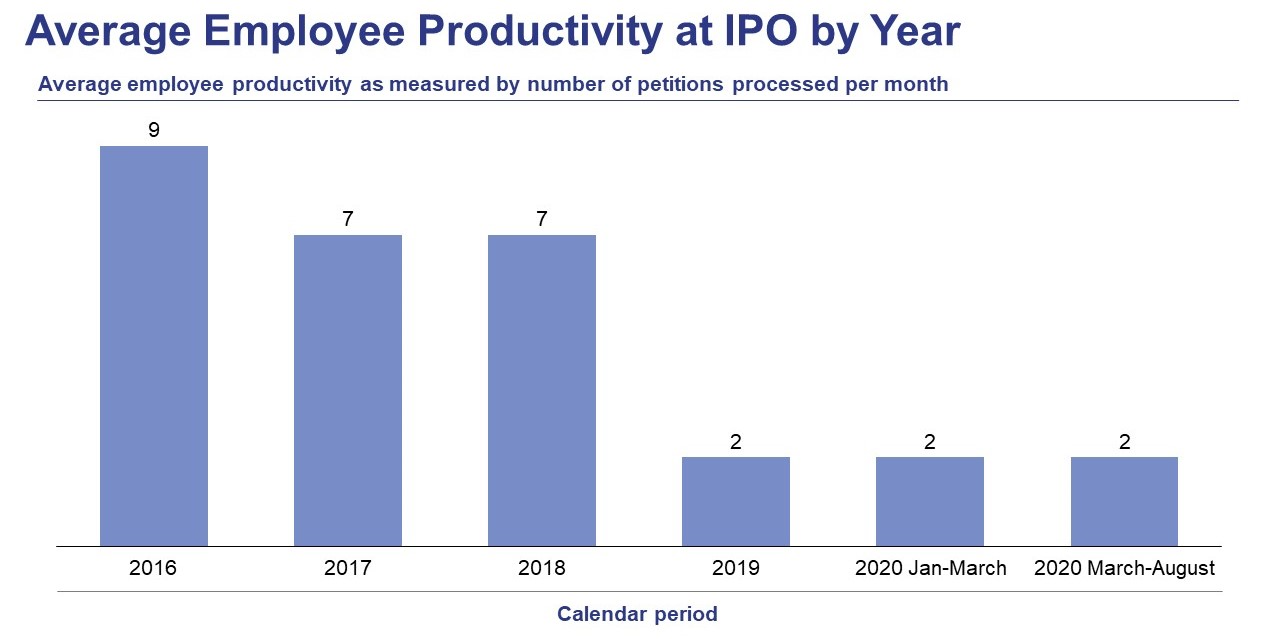

Sarah Kendall has been the acting chief of the IPO since FY2019, and since then, I-526 and I-829 processing volumes have significantly decreased. The processing data from March to August 2020 revealed that the IPO averages 304 I-526 petitions and 265 I-829 petitions adjudicated per month. This is especially shocking after seeing the record-high processing rates in FY2018 when the IPO was still under the leadership of Julia Harrison.

Kendall defended the lower processing volumes by stating that this is increasing the integrity of the EB-5 program. She did not offer any estimations of future processing rates, but instead pointed to the record low processing rates of mid-2019 to attempt to argue that productivity in FY2020 is favorable. If the adjudication rate of FY2020 continues, those planning an EB-5 investment can expect to wait up to three years for their petition to be processed. Those applying from a backlogged country, such as China or Vietnam, may be subject to a waiting period of five years or more.

The following graphs illustrate the change in productivity at the IPO since Sarah Kendall took over as chief. The shift in focus to I-829 petition adjudication is creating an even larger I-526 backlog and diminishing new interest in the EB-5 program. This is making it more difficult for project developers to acquire investment capital for EB-5 projects. If the IPO’s productivity does not increase in FY2021, it could be detrimental to the EB-5 Immigrant Investor Program.