The EB-5 Immigrant Investor Program is considered to be one of the fastest and easiest ways to permanently relocate to the United States. The program was created by Congress in 1990 as an attempt to stimulate the U.S. economy with foreign capital. Foreign nationals are offered the chance to receive U.S. green cards for themselves and their immediate family members in exchange for a qualifying investment in a new commercial enterprise (NCE). Since its enactment, the program has gain popularity with foreign nationals all over the world that dream of a brighter and safer future in the United States.

Minimum Investment Required

Until November 2019, foreign nationals were required to invest a minimum of $1 million in an NCE to be eligible for the EB-5 program. If the NCE was located in a targeted employment area (TEA), the minimum investment amount was lowered to $500,000. However, in November 2019, the new Modernization Rule took effect, which raised the minimum investment amount to $1.8 million, or $900,000 for TEA projects.

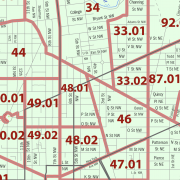

For a project’s location to be designated as a TEA, it can either be an area with high unemployment or a rural area. The lower investment amount is used to encourage EB-5 investors to invest in areas that are more in need of capital and economic stimulus. To qualify as a high-unemployment TEA, an area must be in an urban region with an unemployment rate 150% that of the national average. A rural TEA must be located outside of a metropolitan statistical area (MSA) and have a population less than 20,000 people.

Key EB-5 Investment Requirements

Aside from the minimum investment requirement, applicants must meet several additional requirements to become eligible for an EB-5 visa. The meet the key requirements of the program, applicants must

- demonstrate that they have invested the minimum amount required into a qualifying EB-5 project,

- satisfy the source-of-funds requirement by documenting all the lawful sources of their EB-5 investment capital,

- keep their investment “at risk” for the entire duration of the two-year investment period, and

- prove that their investment has led to the creation of 10 new full-time jobs for U.S. workers.

The EB-5 Regional Center Program

Many foreign nationals who choose to pursue an EB5 investment decide to invest through an EB-5 regional center rather than directly in an NCE. This is an extremely popular option because of the many benefits it offers the investor.

EB-5 investors are required to take part in the day-to-day decisions and operations of their EB-5 project. However, if investing through a regional center, the investor usually signs on as a limited partner and allows the regional center manager to handle the managerial tasks of the NCE. This is more appealing to investors who lack managerial experience but still want to complete an EB-5 investment. The investor’s lack of managerial experience will not affect the success of the EB-5 project, and the investor is free to live anywhere since they are not tied to the location of the NCE.

Another major appeal to investing through a regional center is the relaxed job creation requirements. When an investor chooses to invest directly, they can count only direct jobs toward the 10 new jobs for U.S. workers. This means the jobs must be on the NCE’s payroll. But when investing through a regional center, investors can also count indirect jobs, including jobs from the NCE’s service providers and external suppliers.

Despite the advantages, some investors still choose to invest directly so that they have more control over their EB-5 investment capital and the managerial decisions of their chosen NCE. Regardless of what a prospective investor chooses, both routes can lead to a U.S. green card. Prospective investors should carefully research the EB-5 program and discuss their goals with an experienced immigration attorney to ensure they pursue the best path for their situation.